Investment Grade Diamonds: Colorless & Fancy Yellow Engagement Rings

A lot of people will argue that diamonds are not a good investment. While that may be true for the vast majority of diamonds out there, if you know what to look for in diamond investments and you choose investment grade diamonds (colorless and fancy yellow), they can surely be a smart and very profitable investment over time. If not, how else would people be selling diamonds at auctions for millions of dollars, for substantial profits?

Right now is an unprecedented buyer’s market. There has never been a better time to invest in diamonds. As a buyer, you can set the price in negotiation. We know this because we sell investment grade diamonds at Raymond Lee Jewelers in Boca Raton.

Diversify your portfolio with one of the most desirable, durable, everlasting physical commodities the planet has to offer.

IS A DIAMOND A GOOD INVESTMENT?

Diamonds can make for a great investment as they are a physical commodity that will always be in demand and will last forever. That being said, not all diamonds are created equal. What makes any given diamond a good investment will depend on a variety of factors. To be considered an “investment grade diamond”, it needs to be a large carat weight with a good cut, color and clarity.

In this post, we are going to cover everything you need to know about investment grade diamonds. That way you know what to look for when investing in diamonds and diamond rings & jewelry.

WHAT ARE INVESTMENT GRADE DIAMONDS?

The Earth has an abundance of diamonds. However, the vast majority are industrial grade diamonds, which have a very limited range of values.

In fact, around 80% of diamonds mined are used for industrial purposes.

Diamonds worthy of jewelry are far more rare. And one’s worthy of an honest investment, even more so…

Investment-grade diamonds are large and polished to the highest standard, graded by the Gemological Institute of America (GIA), with color and purity that are in demand around the world.

If a diamond meets the right criteria, it will see higher appreciation in value over time. This is what makes certain diamonds “investment-grade”.

10 Carat Fancy Yellow Cushion Cut Diamond

DO DIAMONDS APPRECIATE IN VALUE?

Investment grade diamonds will appreciate in value over time. How much they will appreciate depends on the diamonds carat weight, cut, color and clarity, as well as the global market demand.

Diamonds that are flawless, perfectly cut, colorless and large will always be in demand and they will continue to fetch a higher price in the market due to scarcity. There is a lack of high quality diamond discoveries over the past several decades. This, coupled with increased demand, is why investment grade diamonds have seen around a 14% increase in value year over year since as early as the 1960s.

It’s not just colorless diamonds that are appreciating in value either. Investment grade fancy colored diamonds are very rare, and there has been a significant increase in demand over the years.

From 2002 to 2012, the price of a 1 carat fancy yellow diamond has seen an appreciation of 322%. That’s an annual return of around 32%! That qualifies as a great investment…This is even more impressive when you consider this data includes the Great Financial Crisis which occurred in 2007-2008.

Yellow Diamonds at Auctions

The demand for fancy yellow diamonds can be seen by looking at auctions over the past 15 years.

High quality yellow diamonds are exceeding $300,000 per carat at auction, and we can see their price of appreciation is not subsiding.

Economists consider fancy yellow diamonds above 2 carats to be great investments, thanks to the rapidly increasing fashion trend of fancy yellow diamond jewelry and the lack of new mine discoveries.

Now that we know there is great investment potential in diamonds, let’s discuss, in-depth, what to look for in investment grade diamonds. We will start with colorless investment grade diamonds and then fancy colored investment grade diamonds.

INVESTMENT GRADE COLORLESS DIAMONDS

Investment grade colorless diamonds are qualified by the 4C’s: carat weight, cut, clarity, and color. We placed carat weight first because when it comes to investing in diamonds, if you aren’t dealing with a large enough diamond, the rest of the 4C’s don’t even matter. On the flip side, it’s not all about size. For a diamond to have investment qualities, it must have a high grade cut, and clarity and color that is in demand as well.

Another big aspect of investment grade diamonds is their desirability for engagement rings, as engagement rings represent half of the value of global diamond transactions. If the diamond doesn’t posses color, size and purity worthy of an engagement ring, it is simply not as liquid.

Let’s look at each of the 4C’s so we can break down each aspect in more detail.

Carat Weight

Carat weight is measured in grams – 0.2grams is one carat.

Diamonds of smaller carat weight are much more common. As the carat weight increases, the value of the diamond rises, and the increase is rapid. It’s not as if a 2 carat diamond is double the price of a 1 carat diamond. The bigger the diamond, the more rare it is, thus the more value it has.

Let’s look at a simple formula that is standard for the diamond investment industry.

Diamond Pricing Formula:

Taverniel’s law is used in determining the price of a diamond.

W = Weight in carats

C = Basic price of a one-carat stone

Price = W² * C

So, it would break down something like this…

- 1 carat = $1,000

- 2 carat = $4,000

- 5 carat = $25,000

- 10 carat = $100,000

This is just a general example as the other 4C’s come into play when pricing a diamond.

Note: there are considerable price shifts as the carat weight edges to the next numeral. For example, a 1.90 carat diamond will cost significantly less than a 2.1 carat diamond of similar quality. The same 0.2 carats jump is much less significant when comparing to a 1.5 and 1.7 carat.

Now, when it comes to investment grade diamonds, they are typically a minimum of 0.5 carats.

0.5 carats to 2 carats are the most liquid, as they are the most common size for engagement rings. However, when diamonds are larger than 2 carat, they have much more potential to appreciate in value. They just might be harder to sell.

When a diamonds of good quality is over 10 carats, you are dealing with the cream of the crop of investment grade diamonds.

Cut

The cut of a diamond is probably the most important factor when it comes to a diamonds beauty, and thus, its value. While investment grade diamonds with the highest value are large, they are also cut beautifully.

Cut refers to the proportion and finish of a diamond. This is a man-made feature. Unlike the other 4C’s.

Cut is graded as follows (from best to worst): Triple Excellent, Excellent, Very Good, Good, Fair, Poor.

The higher the cut grade, the more value the diamond has.

Investment-grade diamonds have a cut that allows light to reflect out of the face of the diamond, minimizing leakage while maximizing brilliance, fire, and scintillation.

Color

When it comes to white diamonds (or colorless diamonds), the less color the better. They are graded from D to Z, with D being zero color. Z indicates the presence of color (usually a brownish or yellow tint).

While D color is the most expensive diamond for engagement rings, it doesn’t make it the best investment as they are hard to liquidate due to the fact they are so expensive. They have a limited market because of this.

So, for investment grade diamonds, F-J color is typically the best. That being said, a large diamond with a D-E color grade will be extremely valuable. It will just be harder to sell. Nevertheless, this is why auctions exist.

Clarity

Clarity has to do with flaws. Flaws affect visibility in colorless diamonds. So the better the clarity, the more valuable the diamond.

Clarity grades are as follows: F (Flawless), IF (Internally Flawless), VVS (Very, Very Slightly Included), VS2 (Very Slightly Included) and SI1 (Slightly Included), SI2, and I1 (Included), I2, I3.

Investment grade diamonds with the most appreciation potential range from F to SI1. This is because any clarity grade within this range is flawless to the naked eye. For the most part, a diamond that is flawless to the naked eye is investment worthy.

10 carat Marquise although having a hint of color is a vs2

Investment Grade Fancy Yellow Diamonds

A colorless diamond with a yellow tint is less valuable than diamonds higher up on the color grade scale. These are inferior diamonds by nature.

However, when a diamond is yellow to the point of sparkling fancy vividness, it becomes very valuable. Even novice diamond enthusiasts will recognize the difference. Investment grade yellow diamonds are absolutely stunning.

A simplified look at how diamonds range from colorless to fancy yellow:

Colorless (D-F), Slight Tint of Yellow (K-L), Beige (XYZ), Yellow, Fancy Yellow, Fancy Vivid Yellow

The price starts to drop as you move right on that list, but once you hit yellow, it starts to increase again, and by the time you reach Fancy Vivid Yellow, its price is as much (if not more than) a very high quality colorless diamond.

That is a simplified version of the yellow diamond scale.

X, Y, Z diamonds (on the colorless diamond scale) will often look yellow. Then from there it goes faint, light, fancy light, fancy, fancy dark, fancy intense, fancy vivid. A yellow diamond doesn’t become very valuable until it hits “fancy”.

Note: Yellow diamonds sometimes have a secondary hue. Green and oranges hues make them more valuable, typically speaking. While brown hues make them less valuable.

All in all, investment grade diamonds will be somewhere in the “fancy” range. As with colorless diamonds, they will also have a high grade cut and will have a larger carat size.

10 Carat Cushion Cut Diamond Engagement Ring

ARE YELLOW DIAMONDS A GOOD INVESTMENT?

Fancy yellow diamonds are a great investment. The demand for fancy yellow diamonds (aka canary diamonds) has significantly grown over the past two decades, and the trend is not plateauing at all.

More and more celebrities are sporting fancy yellow diamond investment grade engagement rings, which has greatly increased the awareness and demand.

Couple this with the fact there has been no new discovery of fancy yellow diamond mines and you will see that fancy yellow diamonds are a fantastic investment.

Record-breaking yellow diamond: In 2011, the Sun Drop fancy yellow diamond sold at Sotheby’s auction for $12.36 million USD.

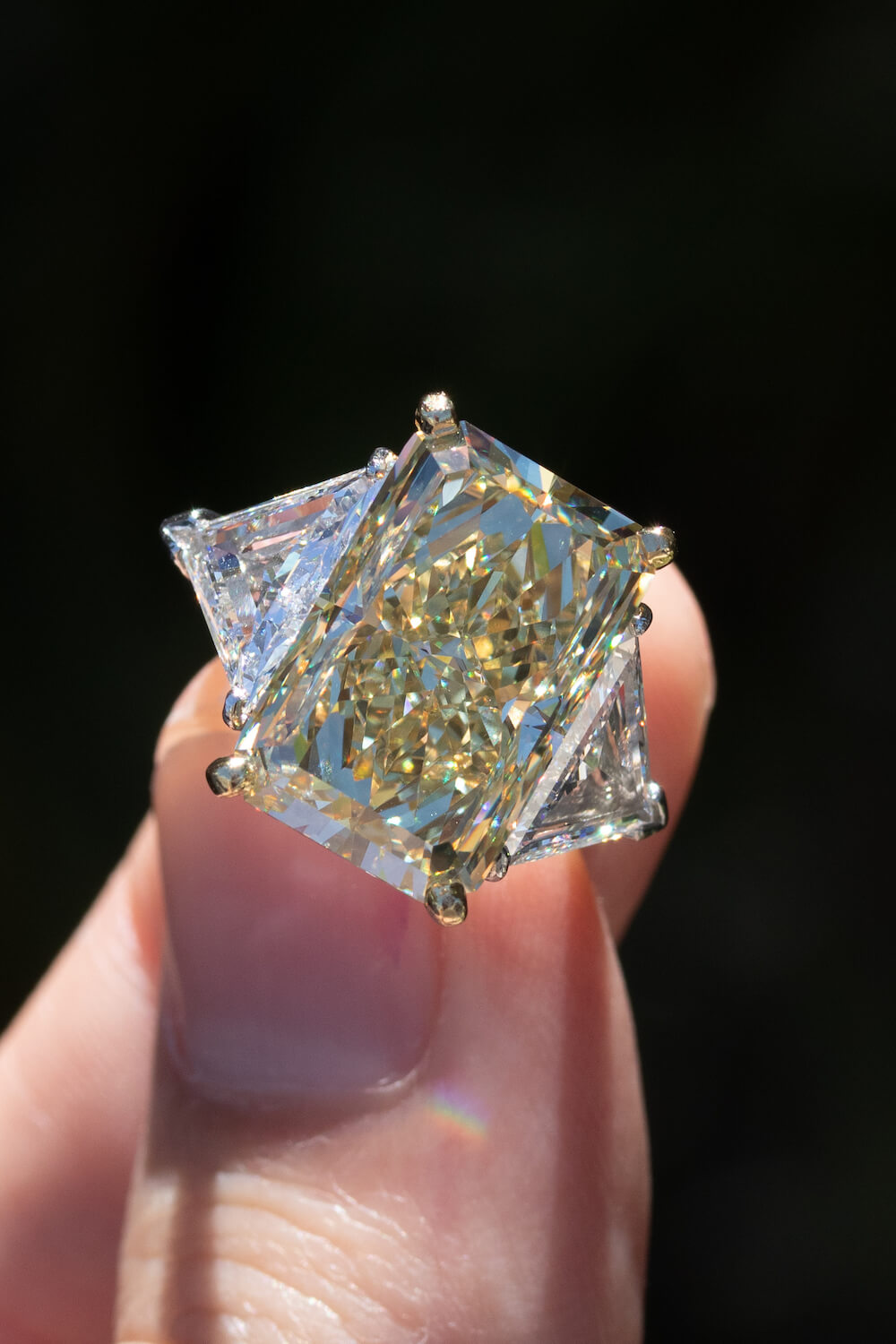

12 Carat Radiant Cut GIA Fancy Yellow Internally Flawless Diamond

QUALITIES OF AN INVESTMENT GRADE YELLOW DIAMONDS

The qualities of investment grade colorless diamonds applies to fancy yellow diamonds. However, the color grading is different, as we ran through just above.

Beyond that, as with white diamonds, the carat weight, cut and clarity will determine its value. Most fancy yellow diamonds naturally have a high clarity grading. So, you will want to look for VS clarity or higher.

As for cut, you want to pay attention to symmetry and polish, as you would with colorless fancy shape diamonds.

Marquise, cushion, radiant, and oval shaped fancy yellow diamonds are the most affordable, allowing for the biggest bang for your investment.

Florescence is another important factor in fancy yellow investment grade diamonds. A faint fluorescence can affect the value slightly negatively, but because yellow diamonds are so rare it’s negligible.

What are the Advantages to Investing in Colored Diamonds?

Fancy yellow diamonds are more liquid. With investments, you need to consider an exit, so this makes fancy yellow diamonds very appealing to investors.

Fancy yellow diamond standout from colorless diamonds at auctions. Plus, they are rarer. There is simply more demand across the globe for yellow diamonds, especially in markets that are evolving and much of the population is rising to middle class and above, like China and India.

GIA CERTIFICATE FOR INVESTMENT GRADE DIAMONDS – IT’S A MUST!

The final point we want to make is about a diamonds certification. Many consider this the 5th C. A certification greatly increases the diamonds appreciation potential.

A paper certificate is done by a third party, assessing the diamonds qualities based on the 4Cs, and its origin. It is physical proof for other investors that the diamond has been appraised by a reputable and objective gemstone laboratory.

As for which laboratory to use, the Gemological Institute of America is the only one you want in our opinion. They are the most highly recognized certificate organization.

GIA verifies and validates the qualities of the diamond’s value. The certificate details blemishes and inclusions, and it can also help identify a specific diamond in the event of loss or theft.

All in all, you want the GIA cert for any investment grade diamond, as will your future buyer when you sell your asset for profit.

WHY INVEST IN DIAMONDS?

Investing in diamonds is a great way to diversify your investment portfolio. They are inflation proof, durable (they last forever), they take up very little room so you can store them yourself in a safe at your home, and you can wear your investment too, making investment grade diamonds both a financial investment and an emotional investment.

8.3 Carat Heart Shaped Fancy Yellow Diamond Engagement Ring

INVESTMENT GRADE DIAMONDS AT RAYMOND LEE JEWELERS IN BOCA RATON

If you want to buy investment grade diamonds, both loose and already set in engagement rings, ready to wear as soon as you buy it, Raymond Lee Jewelers in Boca Raton is the best place in South Florida (and online).

We don’t tack on the premium for the design and the majority of the cost for these diamond rings is in the diamond. These are investment grade diamonds already set for you to wear.

Buyer’s Market

Right now, it is a buyer’s market. We are accepting all reasonable offers. You set the price in the negotiation. If you have the means, now is an unprecedented time for buying investment grade diamonds. When the economy bounces back, you will be thankful you invested in investment grade diamonds.

If you want to get pricing and learn more about our Investment Grade Diamonds, please contact us.

Shop Investment Grade Diamond Engagement Rings